Protect Your Wide Range with Offshore Trust Services: Specialist Financial Solutions

Wiki Article

Establishing Sail for Financial Flexibility: Exploring Offshore Trust Fund Solutions as a Gateway to International Riches Management

Are you all set to start a trip towards economic flexibility? Look no more than offshore trust solutions as your entrance to international riches management. In this short article, we will certainly assist you through the ins and outs of recognizing offshore trust solutions, the benefits they use in terms of asset security, how to select the appropriate overseas jurisdiction, and vital considerations for constructing your own trust fund. Get all set to maximize your returns and dived in for a flourishing future.

Recognizing Offshore Trust Services: A Trick to International Riches Management

Understanding overseas depend on services is vital for those seeking to participate in international riches management - offshore trust services. Offshore trusts are an effective device that allows people to secure and grow their assets in a tax-efficient and confidential way. By placing your properties in an overseas count on, you can gain from legal and financial advantages that are not offered in your house nationOne of the main advantages of offshore trust fund services is the capacity to lessen tax responsibilities. Offshore jurisdictions frequently have extra beneficial tax obligation legislations, permitting you to legally lower your tax obligation concern. This can cause significant financial savings and enhanced riches accumulation gradually.

Another benefit of overseas depends on is the level of possession defense they offer. By placing your properties in a jurisdiction with solid asset security laws, you can secure your wide range from potential financial institutions, claims, or other financial dangers. This can offer you assurance knowing that your hard-earned cash is safe and secure.

Moreover, offshore depend on services supply a high degree of privacy and discretion. Offshore jurisdictions focus on customer privacy, making sure that your monetary events stay exclusive. This can be especially beneficial for people who value their personal privacy or have concerns regarding the safety of their assets.

Benefits of Offshore Depend On Providers in International Possession Security

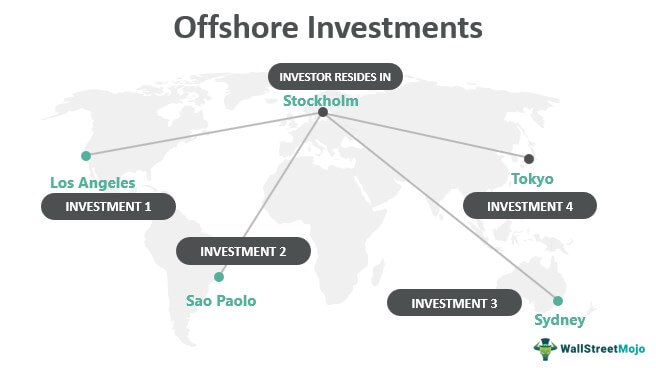

Maximize your asset security with the advantages of offshore depend on services in protecting your global wide range. By establishing an offshore depend on, you can properly shield your assets from legal insurance claims and prospective threats. One of the crucial advantages of overseas count on services is the boosted level of privacy they supply. Unlike traditional onshore counts on, offshore depends on supply a better level of privacy, making sure that your economic events stay very discreet and secured from spying eyes.An additional considerable advantage of offshore trust fund services is the flexibility they use in terms of wide range administration. With an overseas count on, you have the capacity to diversify your properties across various jurisdictions, allowing you to make the most of desirable tax regimes and financial investment opportunities. This can cause substantial tax financial savings and raised returns on your investments.

Furthermore, offshore trust fund services supply a greater level of possession defense compared to domestic trust funds. In the event of a lawful disagreement or financial dilemma, your offshore count on can function as a shield, protecting your properties from possible creditors. This included layer of defense can provide you with assurance and ensure the longevity of your riches.

Checking Out Offshore Jurisdictions: Selecting the Right Place for Your Trust Fund

When choosing the best offshore territory for your trust fund, it's essential to take into consideration elements such as tax benefits and lawful framework. Offshore jurisdictions supply a variety of read advantages that can assist protect your assets and maximize your monetary management. One key variable to think about is the tax advantages supplied by the territory. Some offshore jurisdictions have favorable tax obligation programs that can help decrease your tax burden and optimize your riches. Additionally, the lawful framework of the jurisdiction is critical in making certain the security and safety and security of your trust. It is necessary to select a territory with strong lawful securities and a well-established lawful system. This will certainly provide you with the comfort that your Read Full Report possessions will be secured and your count on will certainly be administered according to your dreams. In addition, the credibility and security of the offshore territory ought to additionally be thought about. Selecting a jurisdiction with a strong credibility and political security can further improve the security and reliability of your trust fund. By very carefully taking into consideration these aspects, you can choose the appropriate overseas territory for your trust fund and begin on a trip in the direction of financial flexibility and global wide range management.Building Your Offshore Trust: Key Considerations and Approaches

Picking the ideal jurisdiction is important when building your overseas trust fund, as it figures out the level of legal defense and security for your assets. Constructing an overseas count on requires mindful consideration and tactical preparation. Most importantly, you need to establish your goals and objectives for the trust fund. Are you seeking to safeguard your properties from prospective lawsuits or financial institutions? Or possibly you wish to lessen your tax responsibilities? When you have actually defined your purposes, it is crucial to research and examine different territories that align with your requirements. Search for territories with strong lawful structures, political stability, and a desirable tax obligation setting. Furthermore, take into consideration the track record and track record of the jurisdiction in taking care of offshore depends on. Consult from professionals who concentrate on offshore trust fund services, such as legal representatives or wealth supervisors, who can lead you through the procedure and help you browse the complexities of overseas jurisdictions. Each territory has its own collection of regulations and policies, so it is vital to understand the economic and legal effects prior to making a decision. By making the effort to carefully choose the appropriate territory, you can ensure that your offshore count on offers the level of security and security you prefer for your possessions.Making The Most Of Returns: Spending Strategies for Offshore Depends On

Buying a diverse profile can assist offshore trusts achieve higher returns. When it pertains to handling your overseas trust, one of the most critical aspects to consider is how to maximize your returns. offshore trust services. By expanding you could try these out your investments, you can alleviate danger and boost the capacity for higher gainsPrimarily, it's vital to recognize the principle of diversification. This strategy entails spreading your investments across different asset classes, sectors, and geographical areas. By doing so, you are not placing all your eggs in one basket, which can assist safeguard your portfolio from potential losses.

When choosing financial investments for your overseas trust fund, it's vital to consider a mix of assets, such as stocks, bonds, realty, and assets. Each property course has its very own risk and return characteristics, so by purchasing a range of them, you can potentially take advantage of different market conditions.

Additionally, remaining educated regarding market trends and economic indicators is critical. By remaining updated with the most recent news and occasions, you can make informed investment decisions and adjust your profile as necessary.

Conclusion

So currently you know the advantages of overseas trust services as a gateway to global riches monitoring. By recognizing the vital factors to consider and approaches involved in building your overseas depend on, you can maximize your returns and protect your assets.In this short article, we will certainly lead you via the ins and outs of recognizing overseas depend on services, the advantages they provide in terms of asset security, how to choose the best offshore territory, and vital factors to consider for building your own trust fund. Unlike conventional onshore trusts, offshore trust funds use a greater level of privacy, making certain that your monetary events stay discreet and safeguarded from prying eyes.

Moreover, offshore depend on services supply a greater level of asset security contrasted to residential trusts.Picking the best territory is vital when developing your overseas trust, as it establishes the degree of legal defense and stability for your assets. Seek recommendations from specialists who specialize in offshore count on solutions, such as attorneys or wealth supervisors, who can direct you with the procedure and aid you browse the intricacies of offshore jurisdictions.

Report this wiki page